Archives

Categories

Profitability of Real Estate Investments in India

India’s real estate sector stands as a steadfast pillar of wealth creation, offering enduring opportunities for investors. Fueled by a robust economy, escalating disposable incomes, and rapid urbanization, the market continues to present a compelling proposition. Let us delve into the factors underpinning the profitability of real estate investments in India over the past decade.

The Indian economy has witnessed a positive trajectory, with escalating business investments propelling demand for commercial spaces. Concurrently, the pace of urbanization has surged, driving the need for residential housing. This convergence of factors has fostered a thriving real estate landscape, providing investors with diverse avenues for growth.

Profitability Potential

Real estate in India offers a distinctive blend of stability and growth potential, evidenced by:

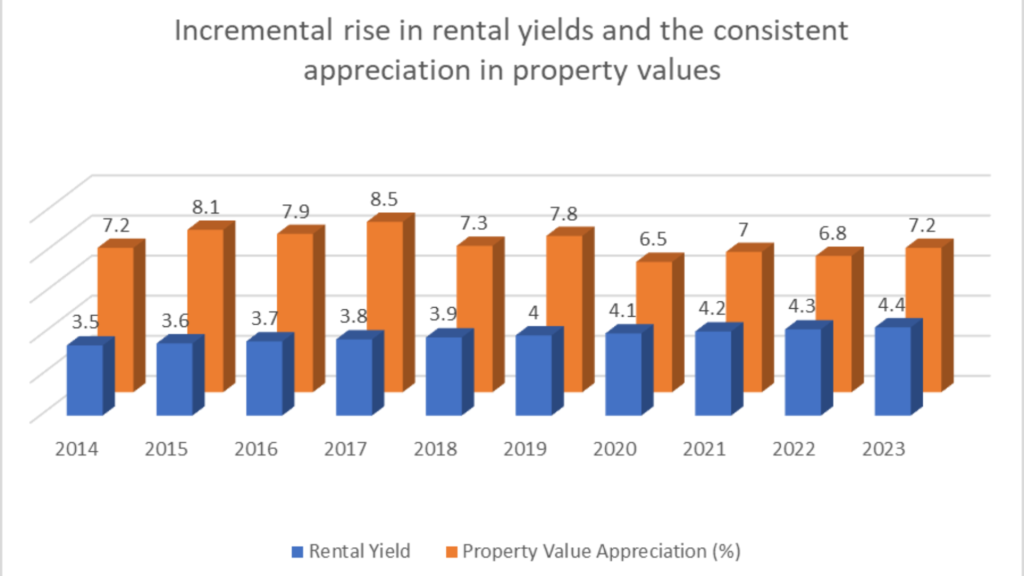

- High Rental Yields & Appreciation: Over the past decade, Indian cities have maintained stable rental yields, typically ranging between 2% to 5% annually. This not only ensures a consistent income stream but also underscores the potential for long-term property value appreciation.

- Safety & Stability: Amidst the volatility of stock markets and cryptocurrencies, real estate stands out as a haven of stability. Historical data from the past ten years showcases a steady upward trend in property values, resilient even during periods of economic uncertainty.

Government Initiatives & Enhanced Transparency

The Indian government has actively bolstered the real estate sector through various initiatives. Schemes like Pradhan Mantri Awas Yojana (PMAY) and the implementation of Real Estate Regulatory Authority (RERA) have not only augmented transparency but also instilled confidence among investors. Furthermore, government-proffered tax benefits and subsidies serve as additional incentives for real estate investment.

The advent of crowdfunding platforms has democratized access to real estate investment. Investors now have the opportunity to participate in property projects with smaller capital contributions, facilitating greater diversification and exposure to a wider array of opportunities.

Strategies for Success

To optimize returns in the Indian real estate market, consider the following strategies:

- Research & Due Diligence: Prior to investing, conduct comprehensive research on market trends, property values, and forthcoming developments in your preferred location.

- Portfolio Diversification: Spread investments across different property types—residential, commercial, or rental properties—to mitigate risk and enhance overall returns.

- Long-Term Perspective: Real estate should be approached as a long-term investment. Exercise patience and evaluate a property’s potential for appreciation and rental income over time.

With its robust historical performance, promising future outlook, and enhanced accessibility, Indian real estate remains an enticing investment avenue. By comprehending market dynamics, adopting a strategic approach, and mitigating risks, investors can harness the profitability of this sector to realize their financial objectives. Remember, real estate is a marathon, not a sprint. Patience, coupled with a well-informed strategy, is paramount to unlocking the enduring rewards this market offers.